I begin with the proverbial WTF? The title of this post sounds a little like the legalese accompanying a witchcraft trial, but it’s jargon that’s all the rage in the ‘trading-carbon-for-biodiversity’ circles.

I begin with the proverbial WTF? The title of this post sounds a little like the legalese accompanying a witchcraft trial, but it’s jargon that’s all the rage in the ‘trading-carbon-for-biodiversity’ circles.

I’m sure that most of my readers will have come across the term ‘REDD‘ (Reduced Emissions from Deforestation and forest Degradation), which is the clever idea of trading carbon credits to keep forests intact. As we know, living forests can suck up a lot of carbon from the atmosphere (remember your high school biology lesson on photosynthesis? Carbon dioxide in. Oxygen out), even though climate change is threatening this invaluable ecosystem service. So the idea of paying a nation (usual a developing country) to protect its forests in exchange for carbon pollution offsets can potentially save two birds with one feeder – reducing overall emissions by keeping the trees alive, and ensuring a lot of associated biodiversity gets caught up in the conservation process.

The problem with REDD though is that it’s a helluva thing to bank on given a few niggly problems essentially revolving around trust. Ah yes, the bugbear of any business transaction. As the carbon credit ‘buyer’ (the company/nation/individual who wishes to offset its carbon output by ‘buying’ the carbon uptake services provided by the intact forest), you’d want to make damn sure that all the money you spend to offset your carbon actually does just that, and that it doesn’t just end up in the hands of some corrupt official, or even worse, used to generate industry that results in even higher emissions! As the buyer, of course you want to entice investors to give you lots of money, and if you bugger up the transaction (by losing the resource you are providing), you’re not likely to have any more investors coming knocking on your door.

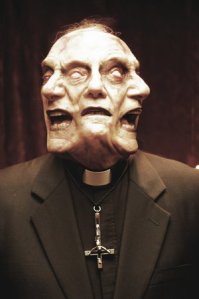

Enter the unholy trinity of leakage, permanence and additionality.

This horrible jargon essentially describes the REDD investment problem: